As a business owner, managing your finances effectively is crucial for the success of your company. One of the key tools that can help you streamline your financial processes is accounting software. In today’s digital age, there are numerous options available in the market, each claiming to be the best accounting software solution for your business. In this article, I will provide an in-depth analysis of the top accounting software options, discuss the benefits of using accounting software, and offer valuable tips for implementing and integrating this software into your business operations.

Benefits of Using Accounting Software

Using accounting software offers a multitude of benefits for businesses of all sizes. Firstly, it saves time and reduces human error. By automating various financial tasks such as invoicing, payroll, and expense tracking, accounting software eliminates the need for manual data entry and calculations. This not only saves valuable time but also minimizes the risk of mistakes that can occur when relying solely on manual processes.

Secondly, accounting software provides real-time visibility into your financials. With just a few clicks, you can generate comprehensive reports that give you a clear overview of your company’s financial health. This allows you to make informed decisions and take proactive steps to improve your financial performance.

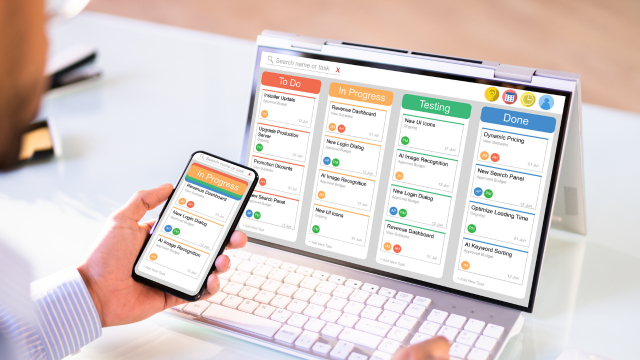

Additionally, accounting software improves collaboration and communication within your organization. With cloud-based accounting solutions, multiple users can access and update financial data simultaneously, ensuring everyone is on the same page. This fosters collaboration between departments and enhances overall efficiency.

Factors to Consider When Choosing Accounting Software

When selecting the best accounting software for your business, there are several factors to consider. The first is scalability. As your business grows, you need accounting software that can accommodate your expanding needs. Look for software that offers scalability in terms of features, storage capacity, and number of users.

Another important consideration is ease of use. Accounting software should be user-friendly, with a intuitive interface that allows even non-financial professionals to navigate and utilize the software effectively. This ensures that all team members can easily input and access financial data, regardless of their level of expertise.

Furthermore, integration capabilities are crucial. Your accounting software should seamlessly integrate with other tools and systems your business uses, such as payroll software or customer relationship management (CRM) software. This avoids duplication of effort and ensures data consistency across platforms.

Lastly, security is paramount. Your accounting software will contain sensitive financial information, so it’s important to choose a solution that offers robust security measures. Look for software that offers data encryption, regular backups, and multi-factor authentication to protect your financial data from unauthorized access.

Top Accounting Software Options in the Market

Now that we have discussed the benefits of using accounting software and the factors to consider when selecting one, let’s delve into the top accounting software options available in the market.

1. QuickBooks

QuickBooks is one of the most popular accounting software solutions for small and medium-sized businesses. It offers a wide range of features, including invoicing, expense tracking, inventory management, and payroll processing. QuickBooks also integrates with various third-party applications, making it highly versatile.

2. Xero

Xero is another leading cloud-based accounting software solution. It is known for its user-friendly interface and robust features. Xero offers features such as bank reconciliation, invoicing, expense tracking, and project management. It also integrates seamlessly with over 800 third-party applications, providing extensive customization options.

3. Zoho Books

Zoho Books is an affordable accounting software solution that caters to small businesses. It offers features such as invoicing, expense tracking, bank reconciliation, and inventory management. Zoho Books also integrates with other Zoho applications, allowing for an integrated suite of business tools.

4. Sage Intacct

Sage Intacct is a comprehensive accounting software solution designed for mid-sized and large businesses. It offers advanced features such as multi-entity consolidation, revenue recognition, and project accounting. Sage Intacct also provides robust reporting and analytics capabilities, making it ideal for businesses with complex financial needs.

5. FreshBooks

FreshBooks is a cloud-based accounting software solution aimed at freelancers and service-based businesses. It offers features such as time tracking, client management, and expense tracking. FreshBooks also integrates with various payment processors, allowing for seamless online invoicing and payment collection.

Detailed Review of the Best Accounting Software Options

Now that we have highlighted the top accounting software options, let’s dive into a detailed review of each software to help you make an informed decision.

QuickBooks

QuickBooks is a versatile accounting software that caters to businesses of all sizes. It offers a user-friendly interface, making it accessible to both accounting professionals and non-financial users. QuickBooks provides features such as invoicing, expense tracking, inventory management, and payroll processing. It also integrates with various third-party applications, allowing for extensive customization. QuickBooks offers different pricing plans to suit different business needs, making it a popular choice among small and medium-sized businesses.

Xero

Xero is a cloud-based accounting software known for its ease of use and robust features. It provides features such as bank reconciliation, invoicing, expense tracking, and project management. Xero’s user-friendly interface makes it ideal for small businesses and non-financial professionals. It also offers seamless integration with over 800 third-party applications, providing extensive customization options. Xero offers different pricing plans based on the size and needs of your business, making it a flexible choice for businesses of all sizes.

Zoho Books

Zoho Books is an affordable accounting software solution for small businesses. It offers features such as invoicing, expense tracking, bank reconciliation, and inventory management. Zoho Books also integrates seamlessly with other Zoho applications, allowing for an integrated suite of business tools. It provides different pricing plans to suit different business needs, making it an accessible option for small businesses with limited budgets.

Sage Intacct

Sage Intacct is a comprehensive accounting software solution designed for mid-sized and large businesses. It provides advanced features such as multi-entity consolidation, revenue recognition, and project accounting. Sage Intacct offers robust reporting and analytics capabilities, which are essential for businesses with complex financial needs. It offers tailored pricing plans based on the size and needs of your business, making it a scalable choice for growing companies.

FreshBooks

FreshBooks is a cloud-based accounting software solution aimed at freelancers and service-based businesses. It offers features such as time tracking, client management, and expense tracking. FreshBooks’ user-friendly interface makes it accessible to non-financial professionals, allowing them to easily manage their finances. It integrates with various payment processors, enabling seamless online invoicing and payment collection. FreshBooks offers different pricing plans to accommodate businesses of different sizes, making it an affordable option for freelancers and small service-based businesses.

Comparison of Pricing and Features of Accounting Software

When choosing accounting software for your business, it’s important to consider the pricing and features of each option. Here is a comparison of the pricing plans and key features of the top accounting software options discussed earlier:

| Accounting Software | Pricing Plans | Key Features |

|---|---|---|

| QuickBooks | Various plans | Invoicing, expense tracking, inventory management, payroll processing |

| Xero | Various plans | Bank reconciliation, invoicing, expense tracking, project management |

| Zoho Books | Various plans | Invoicing, expense tracking, bank reconciliation, inventory management |

| Sage Intacct | Tailored plans | Multi-entity consolidation, revenue recognition, project accounting |

| FreshBooks | Various plans | Time tracking, client management, expense tracking |

By comparing the pricing plans and key features of each accounting software option, you can determine which one aligns best with your business needs and budget.

Tips for Implementing and Integrating Accounting Software into Your Business

Implementing and integrating accounting software into your business can be a complex process. Here are some valuable tips to help you navigate this transition smoothly:

- Plan Ahead: Before implementing accounting software, take the time to plan and define your goals. Identify the specific financial processes you want to streamline and the key features you require in the software.

- Train Your Team: Provide comprehensive training to your team members to ensure they understand how to use the accounting software effectively. This will minimize errors and maximize the benefits of the software.

- Data Migration: If you are transitioning from manual processes or switching from a different accounting software, ensure a smooth data migration. Consult with the software provider or seek professional assistance to ensure a seamless transfer of your financial data.

- Customization: Take advantage of the customization options offered by your accounting software. Tailor the software to match your business needs and workflows to maximize its effectiveness.

- Regular Maintenance: Regularly update and maintain your accounting software to ensure it remains secure and up to date with the latest features and functionalities.

By following these tips, you can successfully implement and integrate accounting software into your business, reaping the full benefits it has to offer.

Common Challenges and How to Overcome Them When Using Accounting Software

While accounting software offers numerous benefits, there can be challenges along the way. Here are some common challenges businesses may face when using accounting software and tips to overcome them:

- Lack of Technical Expertise: Not all team members may be familiar with accounting software. Provide adequate training and support to ensure everyone understands how to use the software effectively.

- Integration Issues: If your accounting software doesn’t integrate seamlessly with other tools and systems your business uses, it can lead to data duplication and inconsistencies. Choose software that offers robust integration capabilities or seek assistance from a software consultant.

- Security Concerns: With sensitive financial data stored in accounting software, security is a top priority. Ensure your software provider offers robust security measures such as data encryption and multi-factor authentication. Regularly update and patch your software to protect against security vulnerabilities.

- Data Accuracy: While accounting software minimizes human error, it’s still important to review and verify data regularly. Implement internal controls and conduct periodic audits to ensure data accuracy.

By proactively addressing these challenges, you can optimize your experience with accounting software and overcome any obstacles that may arise.

Making the Right Choice for Your Accounting Software Needs

Choosing the best accounting software for your business is crucial for streamlining your financial processes and improving your overall financial performance. By considering the benefits, factors to consider, and reviewing the top accounting software options, you can make an informed decision that aligns with your business needs and goals.

Remember to evaluate pricing, features, and integration capabilities when selecting accounting software. Implement the software effectively by planning ahead, providing comprehensive training, and ensuring smooth data migration. Regularly update and maintain your software to maximize its effectiveness.

Accounting software has the potential to revolutionize your financial management, saving time, reducing errors, and providing valuable insights. Embrace the power of accounting software and take your business to new heights of financial success.